Our Charges – Transparency and Upfront Legal Fees

NO HIDDEN EXTRAS. WHEN TAKING YOUR INSTRUCTIONS, WE WILL:

We will confirm these arrangements in writing, explain what work they cover, tell you about any other foreseeable payments which are likely to be necessary. Unless otherwise agreed costs are calculated on a time basis at the rates set out in the leaflet. Time spent will include meetings with you and perhaps others; considering preparing and working on papers; correspondence; and making and receiving telephone calls.

Click here to read more about our client engagement fees and disbursements

Our client engagement fee applies to all matters.

You can set a limit

You can: set a limit on costs to be incurred without further agreement with you (not the same as an agreed fee), and ask us for details of what costs have been run up at any stage.

We will tell you what costs have been incurred at least every six months, where a matter takes some time.

We will ask you for payment on account of our costs and will ask you for further payments as the matter progresses.

Value Added Tax (VAT) and all payments we make on your behalf (disbursements) will be added to our final account. The current Value Added Tax (VAT) rate is 20%.

If you think your bill is too much, we will be pleased to explain how it has been worked out. If you are still unhappy after that, we can explain your rights to have the bill checked.

Request for a Legal Consultation

Garner & Hancock realise that the prospect of pursuing a legal matter can be challenging, so we offer an initial phone consultation to discuss your options, and to give you information that will help you make the right choices affecting your case.

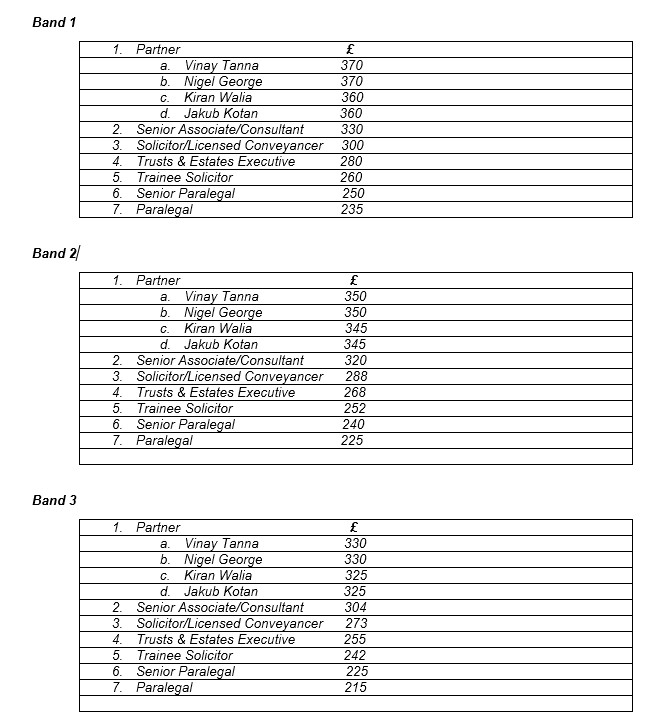

Please note that our hourly charges are assessed on an annual basis. We take into account the Consumer Prices Index when we review our charging rates.

Our charging rates apply unless we have agreed to work on a set fee basis. If we have agreed to work on a set fee basis, excess work outside the original remit will be charged at the rates below.

Hourly Charges 2025/ 2026

Life Planning Department

Uncontested Probate Application Costs – Applying for the grant, collecting and distributing the assets

We have listed two potential estate models with costs, to provide a context into which you can place your own estate circumstances. Please do contact us directly with the details of your estate and we can provide an estimate of costs based on the particular circumstances involved:

When it comes to probate work, every case is different, which means it is extremely difficult to let you know exactly what our fees will be at the very outset of the matter.

Please note that any figures given as to any tax payable are given for example purposes only. Please refer to the links below for the HMRC inheritance tax calculators.

With more straightforward estates, it will be much easier for us to give an accurate estimate of the time required to resolve the matter, and our fees are likely to be lower.

A straightforward estate is likely to be one where:

An estate which includes any of the following matters is likely to be more complex and will generally take more time to deal with, which in turn means that our fees will be higher:

This is a non-exhaustive list but the more information we have about a person, their assets and their circumstances, then the more accurate we will be able to make our estimate.

Simple Estate Model for a Single Person

Rosemary has recently passed away with two accounts held with her local high street bank, two ISA’s held with a local building society, premium bonds and one 65+ NS&I bond. Rosemary owned a freehold property in her sole name, worth under £500,000, and the combined value of all her assets which will be sold or disposed of in any one tax year is less than £500,000. Rosemary has left all to be divided equally between her two adult children. No IHT charge is made based on the value of the estate in this instance.

We would anticipate that the legal work involved in the administration of Rosemary’s estate would take between 8 and 10 hours to achieve Grant of Probate, and a further 5 to 10 hours post Grant unless work is required on income tax matters. The cost of this time would be between £3,500 plus VAT and £6,000 plus VAT, plus disbursements (please see below).

Moderately Complex Estate

David has recently passed away, leaving legacies to various family members and charities, with the residue of his estate passing to his surviving spouse/civil partner. David held accounts with four different high street banks, some joint and some sole ISAs with two building societies, NS&I 65+ bonds and premium bonds, a life insurance policy and five different sets of shares in five different FTSE companies. He jointly owned a large, freehold property worth £800,000, his share being worth £400,000. The estate value, including the property, is £750,000.

We would anticipate that the legal work involved in the administration of David’s estate would take between 12 and 25 hours to achieve Grant of Probate, depending on the complexity of the shareholdings involved, with a further 10 to 12 hours post grant, including the registration of the estate with HMRC and the submission of an income tax return for the period of administration. The cost would therefore be estimated at between £6,000 and £12,000 plus VAT, plus disbursements (see below).

Likely disbursements on this include:

Disbursements are costs related to your matter that are payable to third parties, such as court fees. We handle the payment of the disbursements on your behalf to ensure a smoother process.

The exact cost will depend on the individual circumstances of the matter. For example, if there is one beneficiary and no property, costs will be at the lower end of the range. If there are multiple beneficiaries, a property and multiple bank accounts, costs will be at the higher end.

Potential additional costs

How long will this take?

On average, estates that fall within this range are dealt with within 6 to 12 months. Typically, obtaining the grant of probate takes 20 to 30 weeks. Collecting assets then follows, which can take between 4 to 12 weeks. Sale of shares and land may take longer. Once this has been done, we can distribute the assets, which normally takes 4 to 12 weeks.

Cost of a simple Will (not involving inheritance tax of trusts or multiple beneficiaries)

Lasting Powers of Attorney

Helpful Websites and Calculators. This will help you to work out any additional tax that may be payable.

| Inheritance Tax interest calculator | This is a useful website to help calculate how much interest is due on a payment of Inheritance Tax |

| Inheritance Tax additional threshold calculator | This calculator helps to work out the additional threshold, otherwise known as the residence nil-rate band (RNRB), if a home is left to direct descendants |

| Inheritance Tax reduced rate calculator | This website helps you see if you qualify to pay a reduced rate of Inheritance Tax |

| Inheritance Tax: grossing up calculators | This is a government website helping to work out an estate value when legacies in a will are free of tax and other assets are tax exempt |

| Inheritance Tax: guaranteed annuity calculator | A helpful calculator to work out an estimated market value of guaranteed annuity payments when valuing assets of the deceased’s estate |

| Inheritance Tax: quarters calculator for trusts | This will assist you to work out the number of quarters (3-month periods) when Inheritance Tax is charged on a trust for certain chargeable events |

Fixed Charges – We offer fixed legal fees on:

The complexity and urgency of a matter will affect the charging rate. The above charge rates are only a guide and subject to confirmation by letter or e-mail.

Property Department

The people who will be carrying out your matters in our Property Department.

All our legal fees are transparent

Our Team are happy to provide you with a personalised fee estimate by email. Please “Contact our Team” to request this. The information which follows is for information and general guidance purposes only.

Our charges for dealing with residential conveyancing are usually based on a fixed fee basis and within our Estimate of Costs we will always let you know what our charges will be for dealing with your sale, purchase or remortgage. Occasionally, complications may arise during the transaction that can affect the amount that you will pay. We will always let you know if that happens and will explain what the cost will be to resolve the issue. We will agree this with you, before the cost is incurred. We have set out examples of the kinds of issues that can sometimes arise below, together with the typical costs of dealing with them.

You can request a personalised conveyancing fee estimate by filling in our contact form.

We have set out below typical fees for a range of transactions.

Residential Property Sales

Our fees cover all of the work required to complete the sale of your home. Charges are usually offered on a fixed fee basis plus any extra administrative charges and costs paid to others on your behalf (known as ‘disbursements’).

How much will conveyancing for my Sale cost at Garner & Hancock?

Our fixed fees for a typical sale range from £1,600 (plus VAT) for a simple transaction to approximately £6,000 (plus VAT) for a complex transaction plus disbursements (see below). These figures may vary in complex cases. That’s why we at Garner & Hancock will always give you an individual cost estimate at the start of the transaction, taking into account the actual features of your sale or purchase. Our team will always advise you immediately about any complication and discuss any possible impact on price at that stage. Our firm has several regulatory requirements to verify the identity of our clients and perform due diligence checks, which are designed to help prevent fraud and money laundering. As part of our AML compliance processes, a client engagement fee applies at the start of the matter, which includes AML searches. For full details of these charges, please refer to our Client Engagement Fee Table. These checks may need to be undertaken more than once during the legal work.

The scale of our legal fees

| Sale of a Freehold property | Price of property Legal fees |

| Up to £500,000 | £1,600 to £1,800 plus VAT |

| £500,001 – £1,000,000 | £1,800 to £2,500 plus VAT |

| £1,000,000 and above | £2,500 to £6,000 plus VAT |

| Sale of a Leasehold property | Price of property Legal fees |

| Up to £500,000 | £1,700 to £2,000 |

| £500,001 – £1,000,000 | £2,000 to £2,700 |

| £1,000,000 and above | £2,700 to £6,000 |

| Bank Transfer Fee | £40.00 plus VAT |

Third party charges

Land Registry document fee £7-£11 per document.

Landlord’s Information Pack/ Management Pack (Leasehold property only) – Landlords and managing agents supply information packs including insurance and service charges information. Their charges are usually fixed by the landlord and may vary between £150- £500.

How long will it take?

The speed of your transaction from the point at which you accept an offer will depend on a number of factors. In our experience, the average time is between eight and ten weeks.

Your transaction may move more quickly or more slowly depending on the other parties in your chain and the particular circumstances of your transaction. We will always talk to you about the timescale that you have in mind and will stay in touch with you to update you throughout.

What happens?

Every transaction is different but some of the key stages include:

Residential Property Purchases

We will deal with everything that is required to complete the purchase of your new home, including dealing with registration at the Land Registry, payment of Stamp Duty Land Tax (Stamp Duty) if the property is in England or Land Transaction Tax (Land Tax) if the property you wish to buy is in Wales.

Our charges are usually offered on a fixed fee basis plus any extra administrative charges and costs paid to others on your behalf (known as ‘disbursements’). Disbursements are costs related to your matter that are payable to third parties, such as Land Registry fees. We handle the payment of the disbursements on your behalf to ensure a smoother process.

How much will conveyancing for my purchase cost at Garner & Hancock?

Our fixed fees for a typical purchase range from £1,750 (plus VAT) for a simple transaction to around £7,000 (plus VAT) for a complex transaction plus disbursements (see below). These figures may vary in complex cases. That’s why we at Garner & Hancock will always give you an individual cost estimate at the start of the transaction, taking into account the actual features of your sale or purchase. Our team will always advise you immediately about any complication and discuss any possible impact on the price at that stage. Our firm has several regulatory requirements to verify the identity of our clients and perform due diligence checks which are designed to help prevent fraud and money laundering. As part of our AML compliance processes, a client engagement fee applies at the start of the matter, which includes AML searches. For full details of these charges, please refer to our Client Engagement Fee Table. These checks may need to be undertaken more than once during the legal work.

Once your leasehold remortgage has been completed we will serve notice on your freeholder. They will make an administrative charge for this, usually between £100 – £200 plus VAT.

The scale of our fees

Legal fees are based on the price of the property.

| Purchase of property with no mortgage | Price of property Legal fees |

| Up to £500,000 | £1,750 to £2,250 plus VAT |

| £500,001 – £1,500,000 | £2,250 to £2,900 plus VAT |

| £1,500,001 and above | £2,900 to £6,500 plus VAT |

| Purchase of a Leasehold property | Price of property Legal fees |

| Up to £500,000 | £1,995 to £2,295 |

| £500,001 – £1,000,000 | £2,295 to £2,995 |

| £1,000,000 and above | £3,000 to £7,000 |

| Bank Transfer Fee | £40.00 plus VAT |

Payments to others

Land Registry fee – the fee will depend upon the purchase price:

| Price of property | Fee |

| £0- £80,000 | £20 – £45 |

| £80,001 – £100,000 | £40 – £95 |

| £100,001 – £200,000 | £100 – £230 |

| £200,001 – £500,000 | £150 – £330 |

| £500,001 – £1,000,000 | £295 – £655 |

| £1,000,001 and over | £500 – £1,105 |

Search fees and Land Registry fees will vary depending upon local charges where the property is situated and the property price.

Stamp Duty Land Tax

Stamp Duty is charged in relation to the purchase price of the property and is increased if you own other properties. You can use the calculator on HMRC’s website for properties in England or the Welsh Revenue Authority’s website, if the property is in Wales.

Additional Fees

We will also charge for the following as additional legal fees: SDLT application £85 plus VAT, Archive fee £30 plus VAT, Telegraphic Transfer £40 plus VAT for transfer of money to the seller’s conveyancer.

Our firm has several regulatory requirements to verify the identity of our clients and perform due diligence checks, which are designed to help prevent fraud and money laundering. As part of our AML compliance processes, a client engagement fee applies at the start of the matter, which includes AML searches. For full details of these charges, please refer to our Client Engagement Fee Table. These checks may need to be undertaken more than once during the legal work..

How long will it take?

The speed of your transaction from the point at which you accept an offer will depend on several factors. In our experience, the average time is between eight and ten weeks. For leasehold properties, then this can increase time scales by another 5 weeks.

Your transaction may move more quickly or more slowly depending on the other parties in your chain and the particular circumstances of your transaction. We will always talk to you about the timescale that you have in mind and will work to meet your expectations where possible.

What happens – Key stages of your transaction?

Every transaction is different but some of the key stages include:

Residential Property Remortgage

We will deal with everything that is required to remortgage your home. including redeeming any existing mortgage and dealing with registration at the Land Registry.

Our charges are usually offered on a fixed fee basis plus any extra administrative charges and costs paid to others on your behalf (known as ‘disbursements’).

How much will conveyancing for my re-mortgage cost at Garner & Hancock?

Our fixed fees for a typical re-mortgage range from £1,000 (plus VAT) for a simple transaction to around £3,500 (plus VAT) for a complex transaction. These figures may vary in cases with special complications. That’s why we at Garner & Hancock will always give you an individual cost estimate at the start of the transaction, taking into account the actual features of your re-mortgage. Our staff will always advise you immediately about any complication and discuss any possible impact on price at that stage. We have several regulatory requirements to verify the identity of our customers and perform due diligence checks, which are designed to help prevent fraud and money laundering. We have put in place significant anti-fraud checks to protect our customers and these are charged between £9.95 and £18.00 (plus VAT) per person. These checks may need to be undertaken more than once during the legal work.

Scale of our legal fees

Legal fees will depend on the amount of funds borrowed

| Up to £500,000 | £1,300 – £3,600 plus VAT |

| £500,001 and above | £1,600 – £3,600 plus VAT |

| Equity Release | £2,100 to £4,100 plus VAT |

| Electronic Money Transfer Fee | £40.00 plus VAT |

Third party charges

Land Registry document fee £6 per document

Landlord’s Information Pack (Leasehold property only) – Landlords and managing agents supply information packs including insurance and service charges information. Their charges are usually between £100- £500 plus VAT.

Once your leasehold remortgage has been completed, we will serve notice on your freeholder. They will make an administrative charge for this, usually between £100 – £200 plus VAT.

Our firm has several regulatory requirements to verify the identity of our clients and perform due diligence checks, which are designed to help prevent fraud and money laundering. As part of our AML compliance processes, a client engagement fee applies at the start of the matter, which includes AML searches. For full details of these charges, please refer to our Client Engagement Fee Table. These checks may need to be undertaken more than once during the legal work.

How long will it take?

The length of time it will take to complete your remortgage depends on several factors, including the requirements set by your new mortgage lender. In our experience, the usual timescale is 2-6 weeks from receipt of your mortgage offer. We will always talk to you about the timescale that you have in mind and will stay in touch with you to update you throughout. Searches currently are taking longer than usual, up to another 3 weeks.

What happens?

Every transaction is different but some of the key stages include:

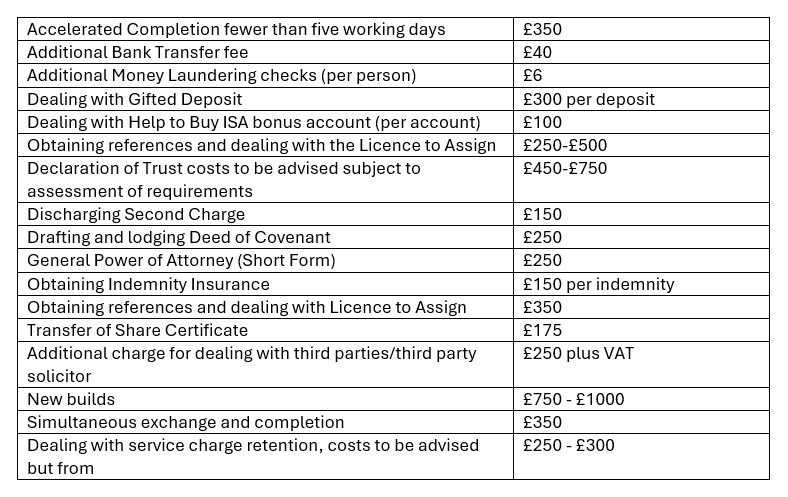

Possible Additional Charges

Every transaction is different and sometimes complications arise that are outside our control. The following list is not intended to be exhaustive but shows some commonly encountered complications which can affect our charges and legal fees.

All the charges below are subject to 20% VAT

Hidden costs to look out for

We at Garner & Hancock will be open and transparent about our costs and legal fees. But in any case, you should always read the terms and conditions. We do not charge such things as:

At Garner & Hancock, we don’t charge any hidden legal fees. We’re always transparent and honest about our quotes and we’ll tell you upfront exactly what you’ll pay.

Do I pay conveyancing fees upfront?

Garner & Hancock will ask for an upfront payment of anywhere between £100 and £1000. This is to cover some of the disbursements, such as searches, client engagement fees, obtaining office copies from the Land Registry and so on.

You shouldn’t then have to pay anything else until:

What fees do first-time buyers pay?

At Garner & Hancock conveyancing fees are the same whether you’re a first-time buyer or you’ve bought a house in the past. You won’t receive any concessions, or be penalised, if this is your first step on the property ladder.

However, If you’re buying e.g. through a shared ownership scheme, there are additional fees due to the extra work involved, which £400 plus VAT.

Are there fees for remortgaging?

Only if the remortgage needs the work of a conveyancer.

When remortgaging, you pay legal fees if there’s a lawyer involved. You’ll usually only need a lawyer if you’re moving to a mortgage deal with a different lender.

Private Immigration Services

Pricing and Service Information

Scope of Work Covered

We provide expert legal advice and representation for a wide range of private immigration matters, including:

- Spouse, partner, and family visas

- Human rights applications

- Indefinite Leave to Remain (ILR)

- British citizenship and naturalisation

- Visit visas

- Skilled Worker and other work-related visas

- Sponsor licence applications

Our Fees

We offer both fixed fees and hourly rates, depending on the complexity of your case. All fees are listed exclusive of VAT (20%) unless otherwise stated.

| Service | Typical Fixed Fee (excl. VAT) | Notes |

|---|---|---|

| Initial consultation (up to 40 min.) | £150 | Deducted from future fees if instructed |

| Spouse/Partner Visa (UK or abroad) | £1,500 | Full Application Service |

| Human Rights Applications | £2,500 | Full Application Service |

| Indefinite Leave to Remain | £1,500 | Full Application Service |

| Naturalisation as a British Citizen | £1,200 | Full Application Service |

| Visit Visa | £1,200 | Full Application Service |

| Skilled Worker Visa | £1,500 | Full Application Service |

| Sponsor Licence Application | £3,000 | Full Application Service |

| Appeals and Judicial Review | £2,500 – £5,000 | Assistance with Court process |

Disbursements

These are additional costs payable to third parties, such as:

- Home Office application fees

- Immigration Health Surcharge

- Translation or interpreter fees

- Courier or postage costs

We’ll advise you of these costs in advance and can handle payment on your behalf where appropriate.

What’s Included in Our Full Application Service

- Initial advice and eligibility assessment

- Document checklist and review

- Preparation and submission of application

- Supporting statements (where necessary)

- Correspondence with the Home Office

- Regular updates throughout the process

What’s NOT Included

- Appeals or tribunal representation (separate fees apply)

- Complex cases involving previous refusals or criminality

- Attendance at Home Office interviews

Timescales

Applications typically take 4 to 12 weeks, depending on visa type and Home Office processing times. We’ll provide a tailored estimate once instructed.

Who Will Handle Your Case

Your matter will be managed by a qualified solicitor or immigration advisor with experience in UK immigration law. All work is supervised by a solicitor with over 7 years of immigration expertise.

Our complaints policy can be found here

Garner & Hancock ~ March 2025